Credentials

SB key advisory transactions

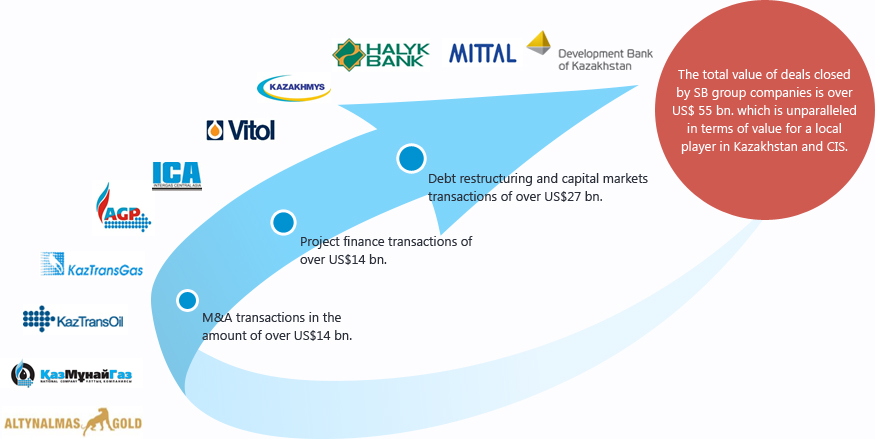

SB Capital is a leader in investment banking market in Kazakhstan, particularly in the oil & gas sector. Among our clients are both private and public companies, including national ones.

Since 2008, SB has participated in variety of major transactions in Kazakhstan:

- Coupon bonds placement KZT20 bn. for Development Bank of Kazakhstan (DBK) in 2014, financial advisor and underwriter. The issue was part of a new DBK bond program totaling to KZT100 bn. The given program and the issue of bonds have been assigned credit ratings from Standard & Poor's and Moody's at BBB+ and Baa3 respectively.

- Eurobond placement for JSC National Company KazMunayGas ("NC KMG"), Lead Manager and Bookrunner of the largest corporate eurobond deal in CIS in 2014. Total issue size US$1.5 billion. The offering is rated BBB (Fitch) / Baa3 (Moody's) / BBB- (Standard & Poor's) respectively.

- Project financing for the construction of Kazakhstan-China gas pipelines AGP (Lines A, B, C) and BSGP. The amount arranged is USD 14 bn, which is the largest amount of debt provided to a Kazakh company.

- Acquisition of Mangystau MunaiGas by KMG and CNPC (50:50) in 2009. MMG is one of the largest exploration and production companies in Kazakhstan and the transaction is one of the largest M&A deals ever executed in Kazakhstan.

- Debut Eurobond placement by KMG in the amount of USD 3 bn in June 2008, in the midst of the financial crisis. The deal was nominated as the Emerging EMEA Bond Deal of the Year 2008 by IFR Thomson Reuters.